Tether’s CEO Paolo Ardoino has warned that the increasing trend away from globalization to localization may lead to more friction in global relations and trade, and the weakening of national economies and currencies, particularly in emerging markets.

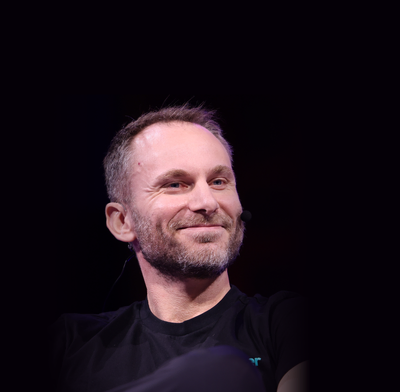

Tether’s Profits Are For Innovation Not Yacht-Buying, CEO Ardoino Says

For context, Tether’s main stablecoin, USDT, is largely used in developing economies as an alternative to fiat currencies.

Speaking to podcaster Anthony Pompliano on Tuesday 5 August, Ardoino discussed the macroeconomic situation and how Tether’s strategic aims fit into this. The Italian-born executive has been increasingly vocal this year as Tether faces growing scrutiny on how it reports on its business.

Given the widespread global uncertainty, the company is investing in what Ardoino called “solid” assets:

- gold

- land

- agriculture

- Bitcoin

Bitcoin is perfection?

He described gold as a competitor to the dollar, providing an edge over fiat currencies. In that way, it is complementary to Bitcoin.

“There is nothing like Bitcoin. It is perfection”

However, he also made the point that cryptocurrency is still in its infancy as an asset class, particularly compared with gold’s long history as a safe deposit of wealth. If there is a major financial reset in the next five years, he said, Bitcoin might not be big enough on its own to support the rebuilding and gold will have a part to play.

When asked specifically about the Bitcoin Treasury trend, Ardoino said he expects some companies to be over-leveraged and that there will be consolidation.

Tether’s US stablecoin

The GENIUS Act has opened up the US domestic market for stablecoins. Ardoini expects there will be hundreds of new stablecoins and Tether is planning to launch its own by the end of 2025, with a tight focus on the user experience and the distribution network.

Ardoini pointed out that the US market is very different from other countries where people are already using USDT because of the US’s comprehensive and reliable retail banking infrastructure.

There are both retail and institutional opportunities in the US, he said, with stablecoins providing “huge opportunities” for intercompany and interbank settlements. Moving away from fiat currencies can make it significantly more efficient to move money, thereby increasing profitability.

Tech advances

“We have made a huge profit and we could give that to shareholders to buy yachts. But that is not us”, said Ardoini.

Instead, he said Tether is planning to use the money to continue innovating, based on the philosophy of using technology to improve lives and to hedge against the takeover of machines. For example, the company is studying the development of AI and brain-to-computer interfaces.

“My biggest challenge is that there are only 24 hours in the day,” Ardoino said, illustrating the extent of Tether’s ambitions.

Questions remain

Tether’s US dollar-pegged stablecoin, USDT, is used by nearly half a billion people around the world, mostly in developing countries. And the company’s performance is striking:

- a profit of over $13 billion in 2024 from its tech and blockchain activities, beyond USDT

- a reported headcount expected to reach just 200 this year

- a holding of $127 billion in US Treasuries, more than both Germany and South Korea, according to Ardoino

Tether has still not been subject to a full financial audit. It relocated its headquarters to crypto-friendly El Salvador in early 2025, where both Ardoino and Chief Operating Officer Claudia Lagorio have reportedly obtained citizenship.

In addition, USDT has in the past been linked to financing terrorists and criminal activity, as well as money laundering, in nearly 60 jurisdictions, according to Tether’s own disclosures.