Tether, the world’s largest stablecoin issuer, has begun to pull back the hood on its investment unit and portfolio.

Tether Unveils Huge Investment Portfolio Fueled by Billions in Profits

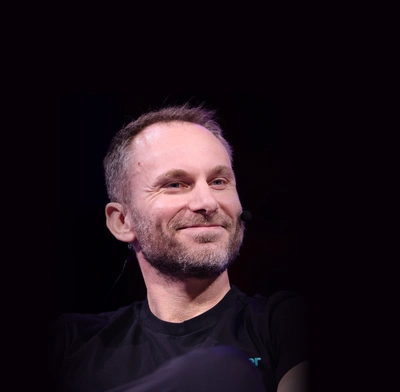

The holdings include more than 120 companies in a wide variety of industries, Tether CEO Paolo Ardonio revealed in a post on X. He expects the portfolio will “grow significantly over the next months and years.”

Crypto & computing investments

The investments that have been showcased are primarily crypto and computing related. Payment solutions such as Fizen, Oobit and Xrex are featured, wallet providers Zengo and Sorted Wallet, and analysis firms Northern Data and Crystal Intelligence are all among the first investments shown. There are also several non-crypto related investments. Juventus, Italy’s most successful football club, Adecoagro, a sustainable food and energy producer and Be Water Media are also included.

Source: X/@paoloardoino

The Tether Ventures website states that it aim to “back projects that reduce reliance on centralized systems, promote privacy, and empower individuals globally.”

Profits deployed

In his post on X, Ardonio noted that the investments have been made entirely from Tether’s own profits which he said amounted to “13.7 billion” in 2024. The company disclosed “net profits exceeding $13 billion” in a 31 January press release, without publishing a detailed financial report.

Since the 2014 launch of USDT, it has become the world’s most widely used stablecoin, and Tether has captured 60% of the stablecoin market.

US market intentions

Ardoino hinted in May that he was exploring the creation of a local digital currency specifically for the US market. With Washington recently passing the GENIUS Act, requiring stablecoin issuers to have 100% reserve backing with liquid assets such as short-term Treasuries, scrutiny on Tether’s capital management may intensify, far beyond the curiosity attached to its venture investments.