Strategy, formerly MicroStrategy, acquired 4,020 Bitcoin at $106,237 during a single week as part of an ongoing buying spree of the original cryptocurrency.

Strategy Increases Bitcoin Holdings to $60 billion and Plans to Buy More

Strategy now holds a total of 580,250 Bitcoin at an average purchase price just below $70,000. With Bitcoin trading at around $105,000, the total value of Strategy’s holding is currently about $60 billion, considerably higher than what it cost to buy.

Sell shares, buy bitcoin

The company funded the acquisition by selling shares in Strategy at the best available prices in current trading, underlining a commitment to the coin as a core treasury asset and cementing its position as the largest corporate holder of Bitcoin. According to BitcoinTreasuries.net, the next biggest corporate holder, MARA, has just over 49,000 Bitcoin.

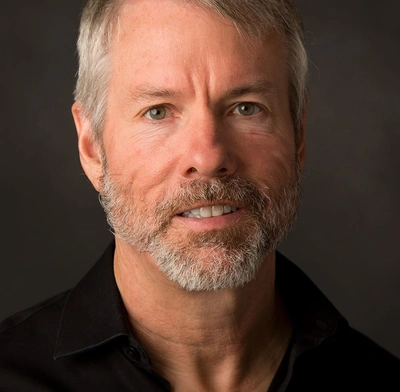

Having spent $427.1 million on the most recently reported purchase, which took place between 19 and 25 May, Executive Chairman Michael Saylor said he’ll buy more.

“We’ll keep buying bitcoin”

Saylor told CNBC on 31 May:

“We’ll keep buying bitcoin. We expect the price…will keep going up. We think it will get exponentially harder to buy Bitcoin, but we will work exponentially more efficiently to buy Bitcoin.”

Commenting on the security of Bitcoin as an asset, Saylor added: “the network is very anti-fragile, and there’s a balance of power here. The more actors that come into the ecosystem, the more diverse, the more distributed the protocol is, the more incorruptible it becomes, the more robust it becomes, and so that means the more trustworthy it becomes to larger economic actors who otherwise would be afraid to put all of their economic weight on the network.”

Although Bitcoin has dropped from its all-time high of nearly $112,000 on 22 May, the price recovered a little following Strategy’s announcement.

Treasury trend

Other companies are following Strategy’s lead by incorporating cryptocurrencies into their treasury strategies. Last week, for example, GameStop invested $513 million in Bitcoin. And Trump Media and Technology Group, which operates the President’s personal social media platform, Truth Social, announced it is raising funds to invest in Bitcoin.

Strategy itself has also announced plans for an IPO of 2.5 million shares to raise a further $250 million, which will be used for buying more Bitcoin and for working capital requirements.