These Bit hoarders have amassed 839,000 – worth about $89 billion at the 24 June price of about $106,000 per coin – in the past years. That means that public companies hold about 4.2% of ’s total .

What began with Strategy’s (formerly ) bold 2020 purchases has blossomed into a full-blown treasury revolution, with companies across racing to add to their balance sheets.

The has rocketed more than 40% since the beginning of the year and expanded the roster of corporate holders from 91 to 136, according to data from Bitcointreasuries.net.

Who’s Leading the Charge?

Credit: Bitcointreasuries.net

Geographically, US-based companies dominate, accounting for 91% of public corporate holders, followed by Canada, 3.4%, with Japan and China trailing behind with 1.7% and 1.6% respectively. Excluding Strategy, the US share dips to less than 70%, while Canada rises to 12%, Japan to 5.8%, and China to 5.4%.

Fresh Faces

Since January, 45 new public companies have entered the arena, together adding 52,156 – equivalent to about $5.5 billion – to the corporate total. The five largest newcomers account for nearly 95% of that influx:

- Twenty One Capital (XXI) purchased 37,230 ($4.0 billion) between May and June. Founded in the US in March by payments company Strike CEO Jack Mallers and backed by , SoftBank, and Cantor Fitzgerald’s Brandon Lutnick (son of the former CEO and now US Commerce Secretary Howard Lutnick), the company not only hoards but also produces educational content, engineers -native lending structures, and issues securities under a pure “ standard” treasury.

- , the American video-game retailer turned meme stock, added 4,710 ($500 million) in January after closing 401 underperforming stores. The company is now funneling cash into crypto as it shifts focus to e-commerce, loyalty , and -based gaming pilots.

- Financial acquired 3,724 ($395 million) in June after raising $750 million in equity and convertible notes. Led by long-term advocate Anthony Pompliano, the US-based holding company plans to hold up to $1 billion in and monetize its reserves via lending, , and other services.

- , a Chinese holographic technology company, 2,353 ($250 million) in March to underwrite its capital-intensive LiDAR sensor and 3D-visualization hardware and software operations, using its reserves to fund research and development.

- a Hong Kong-based company engaged in wet trades works such as plastering and brick laying, set aside 833 ($88 million) between January and February to secure short-term financing and hedge currency risk, ensuring it can pay suppliers promptly for materials and labor on its large-scale residential and commercial construction projects.

Why Bitcoin?

Company leaders hope to mirror Strategy’s remarkable 3,000% stock rally since 2020, believing that convertible-debt financing and other credit strategies can speed up their accumulation. Investors have rewarded these firms with premium valuations, confident they will keep buying as nears new highs. By holding on the balance sheet, companies also signal to shareholders that they are at the forefront of financial innovation.

For many of these firms, isn’t just a bet on price, it’s a way to stand out. In a market where most companies hold cash or bonds, adding is a method of shaping the perception of the company as forward-looking and bold. That alone can attract new investors, especially from the tech and crypto space.

It’s also a financial play. By raising money through stock or convertible bonds while their share price is high, companies can use that capital to buy even more . If prices go up, both the asset and the stock benefit. It’s a feedback loop that’s already paid off for Strategy, and others are hoping to follow the same path.

Overvalued?

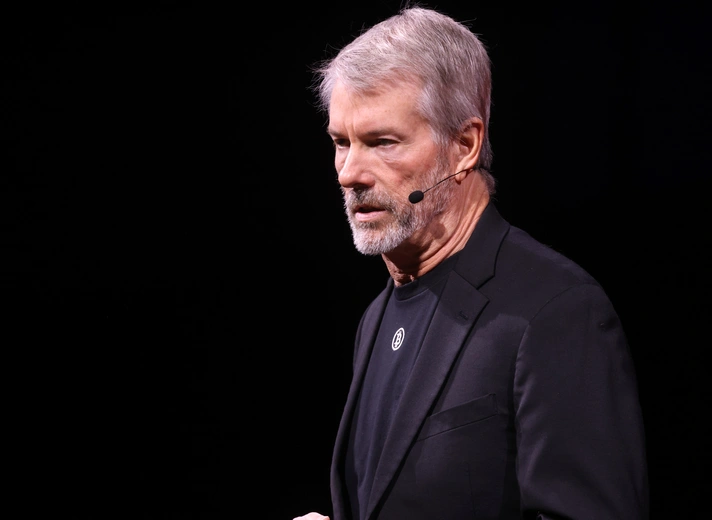

Some critics, led by short-seller Jim Chanos, argue -treasury companies are overvalued, trading at well above the worth of their actual reserves, while supporters like argue these firms simply offer direct exposure to digital assets and even pledge share buybacks if prices dip too low. How this debate plays out could shape not only how companies manage their cash reserves but also crypto’s broader acceptance in the global financial system.

What’s Next

With more companies jumping in, the next phase will likely bring tougher rules around reporting, disclosures, and risk controls. But unlike in previous years, the regulatory climate, at least in the US, is shifting in the crypto industry. Recent moves by lawmakers and regulators to clarify digital asset rules have given companies more confidence to hold without fearing sudden policy reversals.

That clarity is likely to encourage even more corporate adoption, especially as continues to gain legitimacy on Wall Street and in Washington. Still, investors will be watching closely to see how these strategies hold up if prices decline. Whether becomes a permanent fixture in corporate treasure chests or fades as a passing trend will depend on how the regulatory landscape evolves, and whether is in a long bull run – not just another sprint that ends in a stumble.